georgia ad valorem tax 2021

2021 List of Sales and Use Tax Exemptions 28359 KB. Excess Funds and Claim Form 2020 Tax Sale Overage June 2021.

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Levying the tax on retail sales allows for simplicity because there is a taxable event with a transaction allowing for simple valuation.

. Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday June 12 from 400 pm to 1200 am. Georgias Title Ad Valorem Tax Fee TAVT Multistate Taxation Wayfair. 2021 Employers Tax Guidepdf 178 MB Department of Revenue.

TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal. As the table indicates most states have applied a price-based ad valorem tax on retail sales of recreational marijuana. Georgia Tax Center Help Individual Income Taxes Register New Business.

August 30 2021. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. The Tax Commissioners Office serves as agent of the State Revenue Commissioner for the registration of motor vehicles and performing all functions relating to billing collecting disbursing and accounting for ad valorem taxes collected in the county.

Remote Seller SalesUse Tax Obligations to Other States Ten Takeaways from 2020 Part Two Takeaway Points 6 through 10 January 13 2021. 2021 List of Sales and Use Tax Exemptions 2021 List of Sales and Use Tax Exemptions. Sales and Use Tax.

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Although ad valorem taxation is simple it is neither neutral nor equitable. TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance.

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

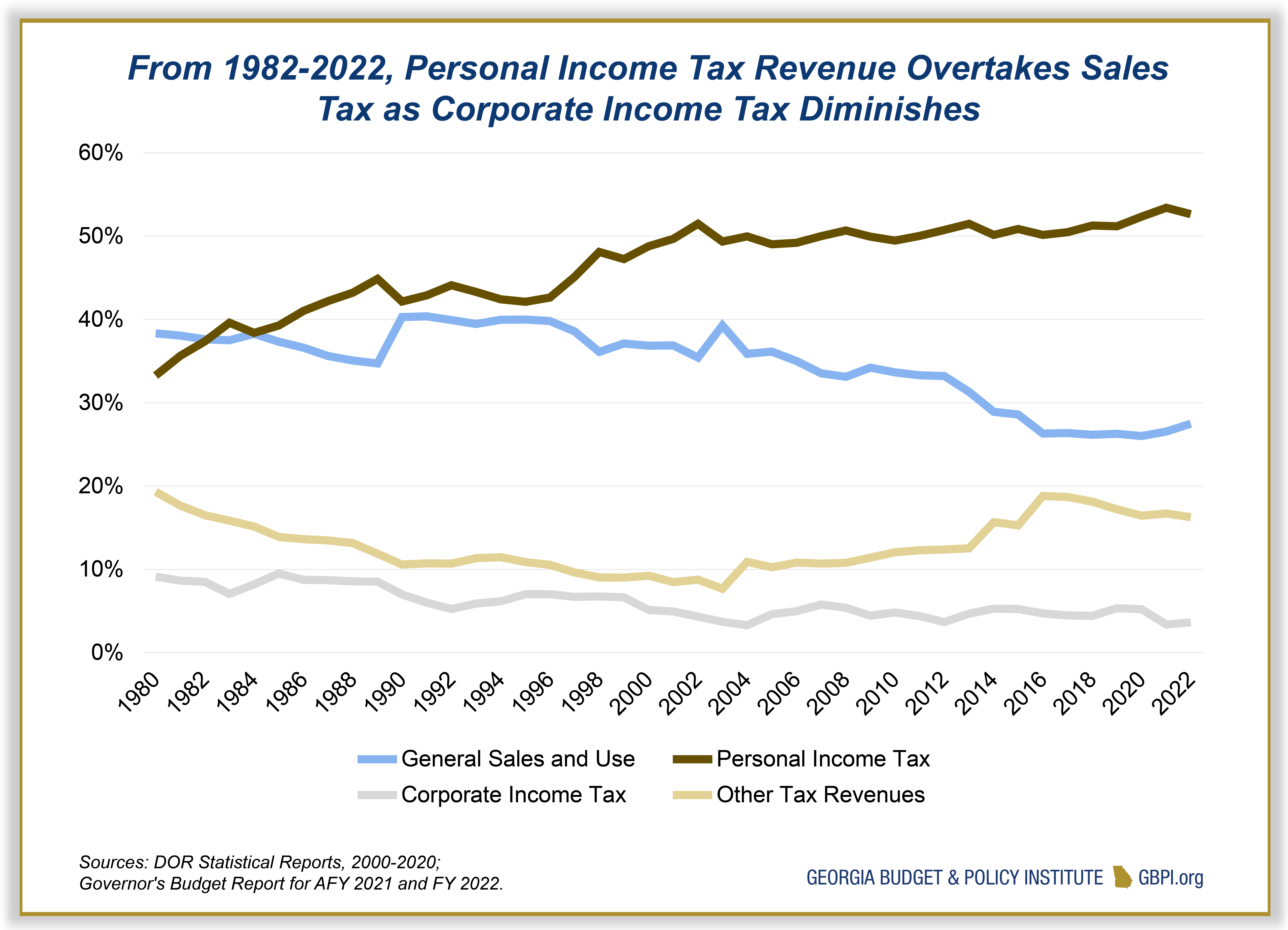

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Sales Tax Small Business Guide Truic

Pin By Melissa Shortt On Aveda Oconee Aveda Embarcadero

Clip Art Outline Of House Property Tax Georgia Properties Home Icon

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Tax Rates Gordon County Government

Property Overview Cobb Tax Cobb County Tax Commissioner

Tax Rates Gordon County Government

Property Taxes Laurens County Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Used Car Sales Tax Fees

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

2021 Property Tax Bills Sent Out Cobb County Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute